Prysmvest real-time risk management tracking

Prysmvest offers powerful real-time risk management solutions that directly address the challenges faced by businesses today. By leveraging advanced analytics, organizations gain immediate insights into their risk exposures, allowing for timely and informed decision-making.

One key feature of Prysmvest is its ability to integrate seamlessly with existing systems. This interoperability ensures that teams can access critical data without the need for extensive retraining or system overhauls. Businesses can start benefiting from risk management tools without interrupting their operations.

Real-time monitoring allows organizations to detect anomalies as they occur, facilitating proactive risk mitigation. With customizable dashboards, teams can visualize risk indicators that matter most to their specific context, ensuring that focus remains on relevant threats and opportunities.

Embracing early warning systems is another strength of Prysmvest. By setting parameters for alerts, users receive notifications before risks escalate, enabling rapid intervention. This feature significantly reduces potential losses and enhances operational resilience.

Incorporating machine learning algorithms empowers Prysmvest to continuously improve its risk assessments. Over time, these systems adapt to new data, refining their predictive capabilities and providing businesses with increasingly accurate forecasts. Thus, organizations can anticipate changes in their risk environment with greater confidence.

How Prysmvest Monitors Market Fluctuations in Real-Time

Prysmvest utilizes a robust suite of tools to track market fluctuations effectively. Real-time data feeds from multiple exchanges enable precise price tracking, providing insights into trends and shifts as they occur.

Data Aggregation and Analysis

The platform aggregates data from various sources, including stock markets, currency exchanges, and commodities. This aggregation ensures a comprehensive view of market movements, allowing traders to react swiftly to emerging patterns.

Advanced algorithms analyze this data, identifying significant deviations that may indicate potential trading opportunities. By employing machine learning, Prysmvest enhances predictive accuracy and adapts to fluctuations more efficiently.

Alert Systems and Dashboard Features

Prysmvest’s customizable alert systems notify users when specific market conditions arise. Whether it’s price thresholds or volume spikes, traders receive timely updates to make informed decisions.

The intuitive dashboard presents real-time visualizations of market indicators, enabling quick assessments of the current situation. Users can monitor multiple assets simultaneously, facilitating quick comparisons and better strategy formulation.

By integrating these features, Prysmvest empowers traders to stay ahead of market fluctuations, optimizing their risk management strategies and enhancing overall trading performance.

Integrating Data Analytics for Proactive Risk Assessment

Utilize real-time analytics to identify potential risks before they escalate. Implement advanced algorithms that process historical data alongside current market trends to generate actionable insights. This proactive approach enhances decision-making, allowing teams to anticipate risks effectively.

Leverage Predictive Modeling

Incorporate predictive modeling techniques to forecast risk scenarios. By examining past data patterns, analytics tools can simulate future risks, helping organizations to prepare responses in advance. Regularly update these models with new data to maintain accuracy and relevance in your assessments.

Foster Collaborative Data Sharing

Encourage collaboration across departments by utilizing a shared data platform. This integration fosters communication and allows different teams to access and analyze relevant information. Establishing a common source of data can significantly enhance the quality of risk assessments and align strategies across the organization.

Customizing Risk Management Strategies for Business Needs

Begin with a clear understanding of your organization’s specific risk profile. Identify key areas where risks manifest, such as operational, financial, or compliance-related segments. Each business has unique vulnerabilities, so conducting a thorough risk assessment forms the backbone of any effective strategy.

Tailored Risk Assessment

Utilize tools like SWOT analysis to pinpoint strengths, weaknesses, opportunities, and threats. Involve stakeholders from various departments to gain diverse perspectives. This collaborative approach ensures that every potential risk is considered and addressed. Regularly update this assessment to reflect changes in the business environment.

Implementation of Technology

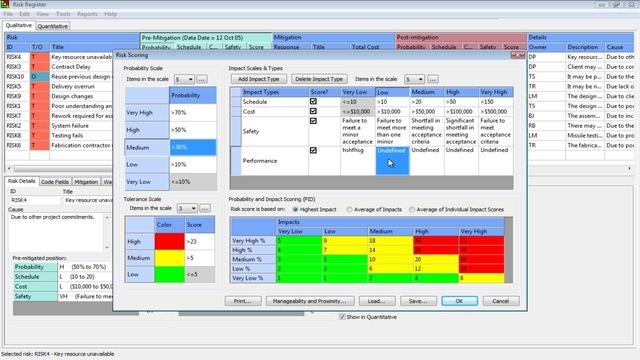

Integrate advanced risk management solutions, such as those offered by prysmvest. These platforms provide real-time data analytics and customizable dashboards, allowing you to monitor risks dynamically. Automation streamlines reporting and alerts, enabling teams to respond swiftly to emerging issues.

Lastly, foster a culture of risk awareness throughout the organization. Regular training and open communication about risk management encourage proactive identification and reporting of potential risks. This mindset not only protects the business but also positions it for sustainable growth.

Video:

The Top 10 Risk Management Software Solutions

The Top 10 Risk Management Software Solutions 3 minutes, 34 seconds